In Copyright Since September 11, 2000. This web site isn't affiliated with, and doesn't represent, any Kaiser entity including but not limited to Permanente. This is instead a public interest nominative use site. Permission is granted to mirror this web site under Creative Commons CC BY-NC-SA 4.0. Please acknowledge where material was obtained.

Link for Translation of the Kaiser Papers | ABOUT US | CONTACT | MCRC|

Kaiser Permanente

Con Perspective

Stacy Ellyson Jacquelyn Nesbitt

November 13, 2002

Prepared for

Dr. Han Vo ECON 693 Winthrop University

Table of Contents

List of Illustrations.................................................................................................................................................... iii Abstract....................................................................................................................................................................... iv Introduction................................................................................................................................................................ 1 History.......................................................................................................................................................................... 1 Discussion.................................................................................................................................................................. 3 Structure............................................................................................................................................................ 3 MarketShare........................................................................................................................................................... 3 Membership............................................................................................................................................................ 4 Integration............................................................................................................................................................... 5 Barrier to Entry........................................................................................................................................................ 5 Conduct........................................................................................................................................................................ 6 Mergers.................................................................................................................................................................. 6 Non-Price Competition............................................................................................................................................. 8 Legal Tactics.......................................................................................................................................................... 8 Performance............................................................................................................................................................... 10 Profits and Losses.................................................................................................................................................. 10 Product Price.......................................................................................................................................................... 11 Product Quality....................................................................................................................................................... 11 Productive and Allocative Inefficiency......................................................................................................................... 12 Technical Progress.................................................................................................................................................. 13 Conclusions................................................................................................................................................................ 14 References.................................................................................................................................................................. 15 Figure 1: Kaiser Membership ................................................................................................................................ 4 Figure 2: Kaiser Operating Revenues ................................................................................................................. 4 Figure 3: Community Benefit Spending 2001 ................................................................................................... 9 Appendix A: Kaiser Permanente Regions ......................................................................................................... 17 Appendix B: Kaiser Permanente Medical Care Program: The Money Trail .............................................. 18 Kaiser Permanente is one of the largest integrated delivery systems in America as well as the nation's largest HMO. The quick growth the organization experienced was potentially harmful to its customers. The question we examined, is being the largest always the best. We look at Kaiser Permanente from a con perspective and point out how this organization is not beneficial to the consumer of healthcare. It also inhibits the physician-patient relationship. Kaiser has had cost problems that have affected its profits but in turn the patient care and satisfaction have been affected. The organization places too much emphasis on reducing costs than it has on patient satisfaction. The conclusion drawn is for improvement Kaiser needs to develop better treatment guidelines with it doctors and patients and allow more freedom of choice among the patients and providers.

As we enter the twenty-first century, managed care has become an integral part of the U.S. health care system. One of the most traditional forms of managed care is the Health Maintenance Organizations (HMO's). Kaiser Permanente is an industry leader and the largest non-profit Health Maintenance Organization (HMO) in the United States. As HMOs such as Kaiser continue to penetrate the markets in which we live, it's imperative that we evaluate Kaiser Permanente's system that so many Americans depend on for their health care.

Our report will illustrate how Kaiser Permanente inherently damages the doctor- patient relationship and interferes with the practice of good, quality health care in America. An analysis of Kaiser Permanente's structure, conduct, and performance will be presented using economic theory from a con perspective.

Kaiser Permanente is an integrated health delivery system that provides healthcare through its health plans, hospitals and physician medical groups. Kaiser started in the late 1930's as an industrial healthcare program for construction, shipyard and steel-mill workers for the Kaiser Industrial companies. Dr. Sydney Garfield established the first prepayment healthcare coverage for workers. At 5 cents per day workers were provided with healthcare coverage for work related problems. For an additional 5 cents per day workers could receive coverage for non-job related problems (Kaiser, 2002).

With the end of World War II and the workers coming to an end at shipyards, employees needing healthcare coverage steadily decreased. This in turn decreased Dr. Garfield's medical staff from 75 to about a dozen. Garfield did not want to stop his new form of healthcare delivery and Henry Kaiser wanted to help him continue this. In 1945 the Permanente Health Plan officially opened for community enrollment. Within ten years of being available to the public the enrollment surpassed 300,000. At that point the success of Permanente Health was largely due to the unions enrolling in the Los Angeles area.

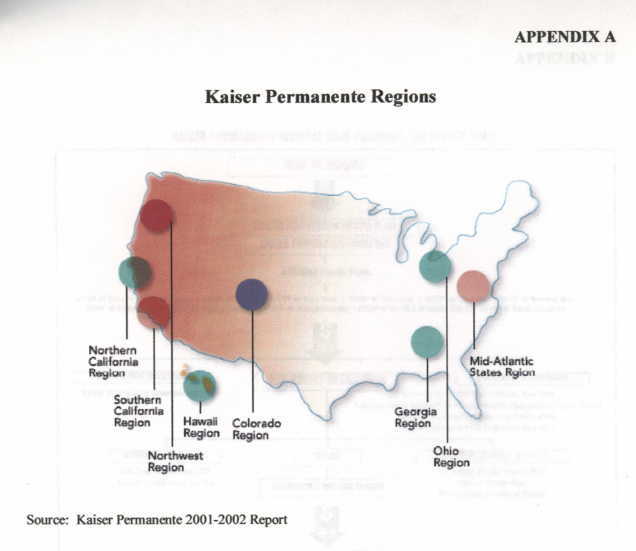

Kaiser quickly grew and by 1982 had reached membership of over four million and expanded across the country to the north east including Connecticut and New York and spread as far south as Virginia. Today Kaiser has over eight million members, 30 medical centers, 423 medical offices and employs over 11,000 physicians and is America's largest not-for-profit health maintenance organization (Kaiser 2002). It is divided into seven regions: California, Colorado, Georgia, Hawaii, Mid-Atlantic, Northwest and Ohio.

During the mid-1990's, Kaiser lost control of its costs and posted three consecutive years of losses. The losses had a negative impact not only financially but also on patient care and satisfaction. during this time Kaiser backed out of several of its' regions and dropped down to the current seven listed previously. The affect this had on Kaiser economically is analyzed further in this paper. In recent years Kaiser's financial situation has significantly improved.

Kaiser Permanente is a non-profit health maintenance organization and America's leading integrated health care organization. Kaiser's central offices are located in Oakland, California, and serves members in nine states and the District of Columbia. Appendix A displays the regions Kaiser Permanente's serves in the United States. Kaiser Permanente comprises of Kaiser Foundation Hospitals, Kaiser Foundation Health Plan, Inc., and the Permanente Medical Groups (Kaiser, 2002).

Kaiser Permanente has gained significant market share during the years through its consolidations and acquisitions. These mergers will be discussed in more detail under the conduct section. Kaiser's 8.4 million members represents about 12 percent market share of HMO members nationally. Approximately five million of those members are located in California alone (Corporate Health Care).

Kaiser is characterized as an oligopolistic firm due to the large market share it holds in most of its markets. As an oligopoly, Kaiser has considerable negotiating control over doctors, hospitals, employers, and patients, which effectively controls the supply of healthcare. However, in some of Kaiser's markets, there is substantial market share in which you find the organization bordering monopoly power.

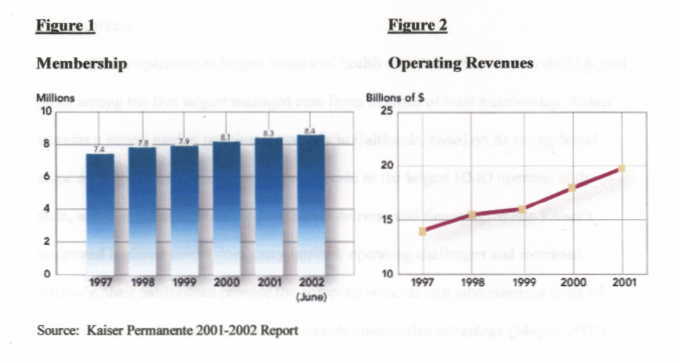

Membership growth at Kaiser has increased significantly over the years. Figure 1 displays the rise in membership at Kaiser with 8.4 million members as of June 2002. Many analysts suggest that Kaiser under priced their products in order to gain market share and increase membership during the early and mid 1990's. Their low rates did increase membership dramatically. With the increase in membership many surveys shows that dissatisfaction with managed care has also risen (NewsHour, 1998).

With the increase in membership, their operating revenues have also increased over the years. Figure 2 displays the increase in revenues with $19.7 billion reported for 2001. Additional information regarding their performance related to profits and losses will be discussed in more detail under the performance section.

Kaiser Permanente is the model for vertical integration in the health care industry. The organization includes the delivery and financing of health care by integrating hospitals, physicians, home health, support functions, and insurance in their system. Kaiser believes that having all these together helps to achieve better economies of scale. This is achieved by the reduction in costs that occur by not having to pay outside physicians. Having to use outside medical care proved costly for Kaiser by contributing to the losses in the late 1990's. (This is discussed further under Performance.)

Kaiser operates the largest integrated health care delivery system in the U.S, and ranks among the five largest managed care firms in terms of total membership. Kaiser sustains a strong market position, especially in California, based on its strong brand name and reputation, significant operating scale as the largest HMO operator in the state, and integrated approach to health care delivery and financing. while Kaiser's integrated business model does carry intrinsic operating challenges and increased intricacy, their model does provide the company selected cost advantages, a point of differentiation in the market, and a sustainable competitive advantage (Meyer, 2002).

Kaiser has experienced barriers to entry in some markets in the country. For example, on January 1, 2000 Kaiser was forced to close its Northeast division due to operating losses. This shut down affected 575,000 members in four states (New York, Connecticut, Vermont, Massachusetts). The HMO was unsuccessful in attracting enough Northeast customers to support its "West Coast style" of managed care. A spokeswoman for Kaiser stated "We do best in urban, densely populated areas." In 1999, Kaiser sold its Texas HMO and closed its Charlotte and Raleigh Durham operations in North Carolina. A consultant with Kaiser reported that the Northeast region area of the country is not ready for Kaiser Permanente's mode of HMO (Fredenheim, 1999).

Most of HMO mergers and acquisitions in 1996 involved for-profits, however in the third quarter of 1996, 95 percent of all acquired hospitals were non-profits. More notably, 80 percent of the buyers were non-profits. Kaiser merger and acquisition activities from late 1996 to the present include:

- Community Health Plan, Inc., Lathan, New York: 350,000 members. - Humana Group Health Plan, Louisville, Kentucky: 118,000 members ($60 million purchase price). - Group Health Cooperative in Washington: 675,000 members. - George Washington University Health Plan, based in Washington, D.C.: 88,000 members. - Health Insurance Plan of Greater New York: 1,100,000 members.The 1996 national health care merger fury involved close to 1,000 deals. In the health maintenance organization sector the average price paid per health plan enrollee was around $558. Kaiser paid $60 million - about $508 per enrollee - in its purchase of Humana Group Health (Corporate Health Care).

As a result of these mergers you will find an increase in patient dissatisfaction and an increasing need for government to regulate the activities of Kaiser to prevent deceitful activities (ASMS, 2002).

The idea for an HMO to make more profits is one of the main reason mergers took place so fast. Some of these ventures faired negative for Kaiser in the '90's. They tried to expand to fast into markets they didn't know very well and had trouble managing care in these markets. They were finding it more difficult in these new markets than in the markets where they'd been around a while (Business & Health Oct. 1999). In the past couple of years Kaiser has not been merging and actually backed out of the Northeast market and it was taken over by an New York based HMO, Capital District Physicians' Health Plan Inc.

There is also the danger that all these mergers and consolidation will limit the competition among HMO's and allow them to impose price increases at will.

Another side of merging for Kaiser was in the form of reducing costs by forming partnership with several suppliers. Several years ago the organization was looking for ways to reduce costs and it began efforts to centralize the purchasing. It formed national purchasing agreements with companies like Office Depot and Compaq Computers. These agreements helped Kaiser save about $100 million in costs over two years (Purchasing Feb. 12, 1998). Having agreements like these helps Kaiser form good supplier-buyer relationships.

Kaiser refers to this method of purchasing as strategic sourcing. This is not necessarily a negative item for the company unless due to having these contracts the organizations may not be purchasing all products at the lowest prices. This may occur because Kaiser is locked into a contract and may have to keep purchasing a specific product even though it may be cheaper from a different supplier. Overall Kaiser feels this is the best cost saving option for them.

Kaiser Permanente has engaged in non-price competition in the past by running advertisements declaring medical decisions were "in the hands of the doctors." A consumer group has taken Kaiser to court of the false-advertising saying it lured thousands of new members by leading them to believe that all medical decisions were made by the doctors they see (Colliver, January 7, 2002). This is an example where Kaiser's conduct (non-price competition) directly affected their structure (membership).

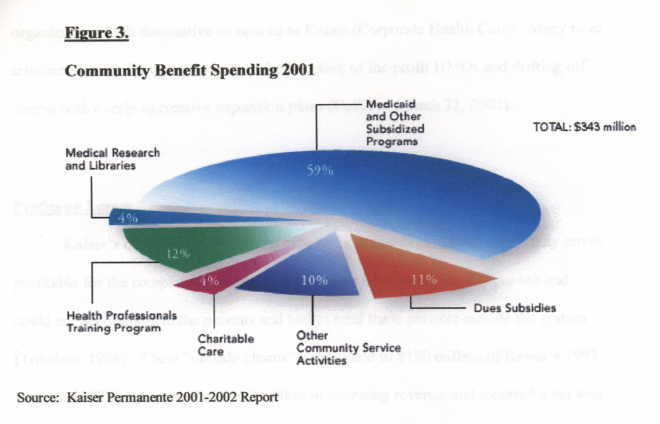

As a non-profit organization, Kaiser has taken advantage of a legal technicality to achieve market dominance. Non-profit means that they operate on funds that are used for operating their business; they do not pay dividends to stockholders or make distributions to investors. They devote a higher percentage of their premiums to patient care than for profits. In addition, for Kaiser this means that they are free from paying any federal income taxes. However, the Internal Revenue Service does require them to contribute services to the community as a condition of its non-profit status. Figure 3 displays Kaiser Permanente's 2001 community benefit spending.

Even with $343 million going to community spending, Kaiser brought in net income of $681 million. It seems Kaiser can be very profitable to the executives, who are paid high salaries (Makeover 62). Appendix A, "The Money Trail", demonstrates how premiums are entered in through the systems going to Kaiser's Foundation Health Plans and hospitals, distributed through for profit operations such as mergers and acquisitions and then has a significant amount of undisclosed profits.

In our evaluation, we found that Kaiser does not differ much from the for-profit health care organizations. Kaiser uses the same economic and management consultants as many of the large for-profit corporations, implements the same downsizing strategies, uses the same care denial and standard of care lowering programs as the for- profit health care sector, and makes the financial empires of almost all other health care organizations look diminutive compared to Kaiser (Corporate Health Care). Many have criticized Kaiser for trying to imitate the structure of for-profit HMOs and drifting off course with overly aggressive expansion plans (Colliver, March 31, 2002).

Kaiser's quick growth to almost nine million members did not necessarily prove profitable for the company at all times. Kaiser was unprepared for this growth and could not accommodate the patients and had to send these patients outside the system (Toledano 1998). These "outside claims" contributed to $180 million of Kaiser's 1997 loss. In 1997 Kaiser recorded $14.2 billion in operating revenue and incurred a net loss of $266 million (Business Wire, Feb. 19, 1999). This trend continued for the company through the ninety's. during the mid-1990s, Kaiser lost control of its costs and posted three consecutive years of losses. The worst, in 1998, was a $288 million net loss (Colliver, March 1, 2002). The company states that a large part of these losses were due to a shortage of nurses and available beds as well as the cost to provide patient care was greater than expected. These include pharmaceuticals, price of new drugs and therapies and hospitalization costs (Business Wire, Feb. 19, 1999).

Kaiser's financial situation has significantly improved. According to Kaiser's 2001-2002 report, their operating revenues for 2001 were $19.7 billion and net income $681 million. If Kaiser Permanente were a for-profit company they would rank 103 on the 2001 Fortune 500 list (Kaiser, 2002).

Like most other HMO's Kaiser has continuously raised rates for its customers. In Hawaii, Kaiser is the states largest health maintenance organization and for 2002 rates increase over 8 percent. This is the largest increase in over four years. Kaiser cited the increase as being due to rising medical costs, new technology and investing in new medical facilities (Sawada 2001). These rising costs mainly affected the small businesses with fewer than 100 employees. In order for these businesses to survive they will pass the majority of the increase on to the consumer or ask the employee to carry a larger portion of the cost. These continued increases in healthcare costs are a contributing factor to the large percentage of Americans uninsured.

Through our research of Kaiser, we found example after example of Kaiser's negligence of good quality health care. As a Kaiser customer, you are limited to what physician you can see and what hospital you can go to. A tragic example of Kaiser's limitations of product quality was a six-month old boy that had become acutely ill. After a long approval process from the Kaiser call center the parents were informed to take their son to a hospital that was 45 minutes away from their home. The parents passed three other hospitals on their way to the Kaiser hospital, one of which was a renowned pediatric center. Once they arrived at the Kaiser hospital the doctors decided to transfer the baby to the renowned pediatric center they had passed earlier. Their son eventually had both hands and feet amputated due to Kaiser's negligence. The Adams' sued Kaiser for medical negligence and the son was awarded $40 million and the parents $5.5 million. As a Kaiser customer, lack of freedom to choose the best hospital or the best doctor for you or your family can be a matter of life or death (Anders, 6-11).

Productive and Allocative Inefficiency

Kaiser's effort to be more efficient certainly hasn't been in the best interests of its consumers. The company implements strategies to save money and in turn has negative implications to the people it serves. For example, in January 2000 Kaiser implemented an incentive program for their telephone clerks at their call centers. The clerks earned a bonus up to 10 percent of their salary if they spent less than three minutes and 45 seconds on the phone and if they arranged appointments for 15 percent to 35 percent of callers. Kaiser claimed this was a pilot program and discontinued it in December 2001. A chief executive at Kaiser explained that "we choose not to provide our patients with what they desired." Furthermore, Kaiser documents suggested the program was implemented to "control demand" and save money (Ornstein, 2002).

Another example shows that due to the high cost of emergency care, Kaiser tightened up their definition of a covered emergency. Kaiser Permanente came up with an especially artful definition of a covered emergency: "medically necessary health services for unforeseen illnesses or injuries that require immediate medical attention as determined by Health Plan." Under that definition, Kaiser can be as liberal or as stingy as it wants. It both administers and defines the benefit, case by case (Anders 137).

A positive advancement for Kaiser is in the technology field. the organization invested over $2 billion in an electronic medical record system. This system is being gradually phased in this fall starting with Northern California. The national clinic information system is to encompass not only medical record keeping but also clinical guidelines and is expected to enhance the clinical visit for patients (PR Newswire Feb. 28, 2002). The concern with this new advancement is that it is sensitive to keeping patient information secure. This could be a positive advancement for Kaiser but it is important to ensure with the open access of the internet that patient confidentiality is protected.

Our analysis illustrates that Kaiser focuses more on managing money and rationing care than on focusing on providing true quality health care. Kaiser sets limits on a customer's ability to see specialists and tightly controls their usage of medical services. In addition, Kaiser limits physicians in giving quality care by requiring them to use the most cost-effective use of medicine. Kaiser Permanente is putting people's lives at risk by ensuring their own financial success.

In order to improve operations, Kaiser must join forces with doctors, employers, and regulators to develop treatment guidelines that people can trust. Doctors must challenge Kaiser's managed-care-rules without fear of being fired. Physicians and nurses must be free to practice their profession to the fullest level of quality for the sole benefit of the patient. Consumers must be in charge of their own care and their own lives. Freedom of choice must be included in the formula for Kaiser to be a truly successful organization.

"A National Agreement for PC's Reduces Buying Costs. (Kaiser Permanente's computer and commodity purchasing contracts)" Purchasing 12 Feb. 1998. http://www.findarticles.com/cf_0/m3148/n2_v124/20320838/print.jhtml

"A Positive financial Performance for 2001 Prepares Kaiser For Future Challenges." PR Newswire 28 Feb. 2002. 5 Nov. 2002 http://www.findarticles.com/cf_0/m4PRN/2002_Feb_28/83345985/print.jhtml

Anders, George. Health Against Wealth: HMOs and the Breakdown of Medical Trust. New York: Houghton Mifflin Company, 1996.

Colliver, Victoria. "David M. Lawrence; CEO led Kaiser through HMO Storm." The San Francisco Chronicle 31 March 2002. 6 Nov. 2002. http://www.consumerwatchdog.org/healthcare/nw/nw002337.php3 http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2002/03/31/BU1983.DTL&hw=David+Lawrence+CEO+led+ Kaiser+through+HMO+Storm&sn=001&sc=1000

---."Lawsuit disputes Truth of Kaiser Permanente Ads." San Francisco Chronicle 7 Jan. 2002. 1 Nov. 2002 http://www.consumerwatchdog.org/ healthcare/nw/nw002149/php3 http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2002/01/07/BU178030.DTL&hw= Lawsuit+disputes+Truth+of+Kaiser+Permanente+Ads&sn=001&sc=1000

---."Kaiser Profit Rises, Boosted by Increase in Premiums: Kaiser Turning a Health Profit." The San Francisco Chronicle 1 March 2002. 5 Nov. 2002. http://www.sfgate.com/cgibin/article.cgi?file=/c/a/2002/03/01/BU166644. DTL&type=printable http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2002/03/01/BU166644.DTL&hw=Kaiser+Profit+Rises+ Boosted+by+Increase+in+Premiums+Kaiser+Turning&sn=001&sc=1000

"Corporate Health Care - For Profit, Not for Profit, or Not for Patients: Kaiser Permanente." 1 Nov. 2002. http://www.calnurse.org/cna/kaiser/booklet

"Do monster mergers threaten managed care?" Business & Health October 1999.

Fredenheim, Milt. "Kaiser Permanente Is Shutting down Its HMO in the Northeast." New York times 19 June 1999. 3 Nov. 2002 http://www.calnurse.org/cna/news/ny061999.html

"Kaiser Permanente Announces 1998 Financial Results" Business Wire 19 Feb. 1999. http://www.findarticles.com/cf_0/m0EIN/1999_Feb_19/53910521/print.jhtml http://ckp.kp.org/newsroom/releases/98results.html

Kaiser Permanente. Welcome to Kaiser Permanente 29 Oct. 2002. http://www.kaiserpermanente.org

Makeover, Michael E. Mismanaged Care: How Corporate Medicine Jeopardizes Your Health. New York: Prometheus books, 1998.

Managed Care and the Capital Coast Health Draft business Plan. ASMS Publications. 5 Nov. 2002. http://www.asms.org/nz/publications/draftcch.html

"Medical Inflation." The NewsHour with Jim Lehrer Transcript June 22, 1998. 4 Nov. 200. http://www.pbs.org/newshour/bb/health/jan-june98/costs_6- 22.html

Meyer, Douglas L. "Fitch Ratings assigns debt and IFS ratings to Kaiser." National Underwriter Life & Health-financial Services Edition 22 July 2002 v106 i29 p28(1).

Ornstein, Charles. "Kaiser Clerks Paid More for Helping Less." The Los Angeles Times 17 May 2002. 1 Nov. 2002 http://www.consumerwatchdog.org/ healthcare/nw/nw002440.php3

Sawada, Kirsten. "Kaiser Permanente to Raise Coverage Rates." Pacific Business News 19 Oct. 2001. v39 i32 p25, http://web7.orgtrac.galegroup.com/ itw/infomark/875/837/2625709927/

Toledane, Jessica "Troubled Kaiser Taking Steps to Return to the Black." Los Angeles Business Journal 30 Nov. 1998 http://www.findarticles.com/cf_0/m5072/ 48_20/53449801/print.jhtml

https://kaiserpapershawaii.org/kpmoneytrail.htm

Source: "Corporate Health Care - for Profit, Not for Profit, or Not for Patients: Kaiser Permanente,." 1 Nov. 2002

Originally located at: http://www.calnurse.org/cna/kaiser/booklet/